The Investor’s Dilemma: When the Market Crashes

You check Yahoo Finance every day—both on your desktop and mobile app. Stock graphs, moving averages, and financial news are part of your daily routine. You invest a set amount each month, holding long positions for years, believing in long-term growth and stability. The market has always gone up over time—until now.

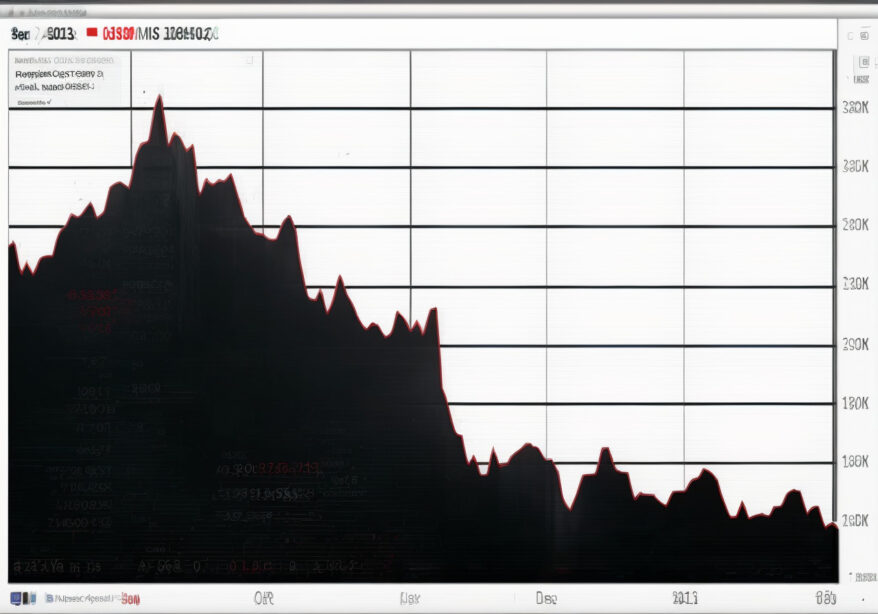

One morning, the red numbers dominate your screen. Your stocks are plunging, and it’s not just a dip—this looks serious. You try to reassure yourself. Market corrections happen. Stocks fluctuate. But this time, it keeps getting worse. Your portfolio is down 10%, then 20%. Headlines scream panic. “The Bubble Has Burst!” “Recession Incoming!” “Markets in Freefall!”

Your heart pounds as you watch your investments shrink. Should you sell and cut your losses? No. You’ve seen this before. Selling at the bottom is a rookie mistake. You know the market always recovers—eventually. But how bad will it get before that happens? And how long will you have to wait?

This time, something feels different.

The Signs of an Impending Market Crash

The financial world is walking a tightrope, and the risk of a major stock market crash in the near future is growing. While markets have experienced an extraordinary bull run, warning signs are flashing red for those paying attention. The following factors could trigger a sharp downturn sooner rather than later:

🔻 Unusually High P/E Ratios: Many stocks are trading at price-to-earnings (P/E) multiples that far exceed historical norms. The S&P 500’s average P/E ratio is well above its long-term trend, a pattern eerily reminiscent of the dot-com bubble of the late 1990s. When valuations disconnect from reality, a sharp correction often follows.

🔻 AI-Fueled Overvaluation: Just like tech stocks in the late 1990s, AI companies are attracting enormous speculative investments. While AI has transformative potential, the market frenzy is pushing valuations into unsustainable territory. Investors piling into AI stocks at all-time highs may be setting themselves up for disaster if the hype wears off.

🔻 Trump’s Tariffs & Trade Wars: The new tariffs and protectionist policies introduced by the Trump administration could have severe consequences for global trade. If countries retaliate, supply chains could fracture, inflation could spike, and economic growth could stagnate—all of which are bearish signals for the stock market.

🔻 Populist & Risky Financial Policies: The current administration is taking aggressive, politically motivated financial actions, including heavy deficit spending and risky deregulation. While these policies may provide short-term market fuel, they create long-term instability that could spiral into a financial crisis.

🔻 Geopolitical Tensions & War Concerns: Markets hate uncertainty, and the threat of escalating conflicts—whether in Eastern Europe, the Middle East, or the Taiwan Strait—creates massive volatility. With global instability rising, investors may begin pulling capital out of stocks, triggering a rapid decline.

🔻 The Fed’s Tightrope Act: The Federal Reserve is balancing inflation control with recession risks. If rates remain too high for too long, it could choke economic growth. If rates are cut too soon, inflation could reignite—both scenarios could lead to a major sell-off.

Lessons from Past Market Crashes

While stock market crashes are painful, history teaches us that they follow familiar patterns. Understanding past crashes helps us recognize when history may be repeating itself:

📉 The 1929 Crash & Great Depression: A speculative bubble in stocks and real estate led to a devastating market collapse, wiping out fortunes and triggering a decade-long depression.

📉 The 1987 Black Monday Crash: A sudden computer-driven sell-off caused the market to plummet 22% in a single day. While short-lived, it revealed the dangers of automated trading.

📉 The 2000 Dot-Com Bubble: Overhyped tech stocks soared beyond fundamentals, then collapsed, erasing $5 trillion in market value. AI stocks today are showing the same dangerous signals.

📉 The 2008 Financial Crisis: Reckless mortgage lending and Wall Street greed led to a global financial meltdown. The crisis proved that systemic risk and leverage can break entire economies.

Navigating the Coming Crash: Smart Investing Strategies

If a stock market crash is coming, how can investors protect themselves and even profit from the turmoil?

✅ Watch for Key Warning Signs: Keep an eye on overvalued stocks, rising interest rates, falling consumer spending, and political instability. When these factors align, the market may be on the edge of a downturn.

✅ Diversify Your Portfolio: Holding only high-growth stocks is a recipe for disaster in a crash. Instead, spread risk across multiple asset classes—stocks, bonds, commodities, and real estate.

✅ Increase Cash Holdings: Having liquidity during a downturn is crucial. A cash reserve allows you to buy stocks at discounted prices when the market bottoms out.

✅ Consider Defensive Stocks: Certain sectors outperform during recessions—consumer staples, healthcare, and utilities tend to hold their value even when the broader market declines.

✅ Avoid Panic Selling: Many investors sell at the worst time—when fear is at its peak. Market crashes are temporary, but losses from panic selling can be permanent.

✅ Look for Buying Opportunities: Warren Buffett’s classic advice: “Be fearful when others are greedy and greedy when others are fearful.” The best time to buy great stocks at bargain prices is when panic is highest.

The Market Will Recover: Positioning for the Future

No matter how severe the next crash, history has shown one undeniable truth:

📈 The stock market always rebounds.

While crashes are painful, they also create extraordinary investment opportunities for those prepared to weather the storm.

🔹 Invest in Strong Companies: The best businesses survive crashes and come out stronger. Look for cash-rich, high-quality companies that dominate their industries.

🔹 Dollar-Cost Averaging: Instead of trying to time the bottom, consistently buying into the market during downturns smooths out volatility and maximizes returns.

🔹 Stay Informed & Adapt: The best investors study history, track key indicators, and adjust their strategies as needed. Knowledge is power in turbulent times.

While the risks of a market crash are real, so are the opportunities. The investors who prepare now will be the ones who thrive when the dust settles.